At a Rand meeting yesterday, Stuart Gabriel called housing the "tail that wags the dog" of the US economy. He was likely referring to this paper or, perhaps, this paper. In any event, the evidence from past business cycles powerfully supports residential construction as a leading indicator.

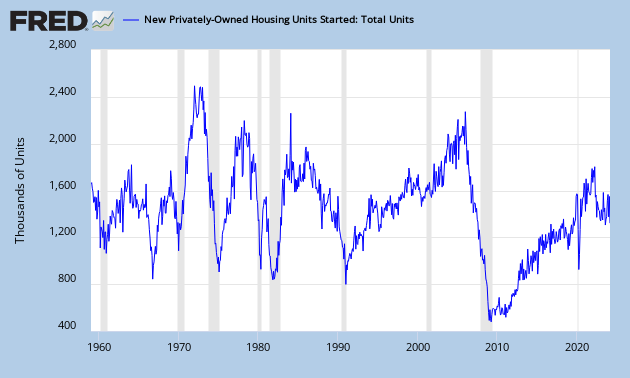

Here is the St. Louis Fed's depiction of housing starts going back to 1959:

In an average year, the US economy starts around 1.5 million houses. It has started fewer than 600,000 per year since 2008, and is currently squiggling along at a bottom unprecedented in the St. Louis Fed series.

I find it hard to see how the economy can recover strongly without housing making a comeback. Yet we still have too many houses--builders cannot compete with the inventory currently available. While they try to differentiate new houses from stuff in the foreclosure stock, it is tough to make a sale when price differences are very large. The problem is that stimulating housing is a bad idea too, because we really don't need many more houses in the economy right now. As my colleague Gary Painter points out, one of the reasons we don't need more houses is that household formations dropped dramatically--we actually lost households early in the recession while population grew. Moreover, according to the Department of Homeland Security, illegal immigration dropped by 2/3 between 2000-2004 and 2004-2009. Whatever one thinks about immigrants (personally, I like them), they do fill up houses.

We are left with a quandary. For the economy to be restored to health, housing construction needs to return to normal--but there is no reason for it to return to normal. The alternative--waiting--doesn't seem very appealing either.

Here is the St. Louis Fed's depiction of housing starts going back to 1959:

In an average year, the US economy starts around 1.5 million houses. It has started fewer than 600,000 per year since 2008, and is currently squiggling along at a bottom unprecedented in the St. Louis Fed series.

I find it hard to see how the economy can recover strongly without housing making a comeback. Yet we still have too many houses--builders cannot compete with the inventory currently available. While they try to differentiate new houses from stuff in the foreclosure stock, it is tough to make a sale when price differences are very large. The problem is that stimulating housing is a bad idea too, because we really don't need many more houses in the economy right now. As my colleague Gary Painter points out, one of the reasons we don't need more houses is that household formations dropped dramatically--we actually lost households early in the recession while population grew. Moreover, according to the Department of Homeland Security, illegal immigration dropped by 2/3 between 2000-2004 and 2004-2009. Whatever one thinks about immigrants (personally, I like them), they do fill up houses.

We are left with a quandary. For the economy to be restored to health, housing construction needs to return to normal--but there is no reason for it to return to normal. The alternative--waiting--doesn't seem very appealing either.